Electric Vehicle Tax Exemption India

Electric Vehicle Tax Exemption India. You might feel that purchasing an electric vehicle is costlier than buying an internal combustion engine vehicle, but that is only because of the higher upfront cost. However, it’s essential to note the.

There are plenty of electric vehicle models on the market, and with increased sales, some automakers are planning to introduce new models. Additionally, individuals are allowed an additional deduction of rs 1.5.

Amongst The Various Tax Saving Investments, Buying An Electric Vehicle (Ev) Has Become One Of The Most Lucrative Ways To Reduce The Tax Liability.

For example, maharashtra has granted subsidy on road tax on electric cars up to rs 1.5 lakh.

Buying An Electric Vehicle With A Vehicle Loan Can Make You Eligible For Income Tax Benefits Under The 80Eeb.

Section 80eeb gives tax deductions of up to ₹1,50,000 on interest paid on loan amount on the purchase of electric vehicle.

1,50,000 Under Section 80Eeb On The Interest Paid On Loan Taken To Buy Electric Vehicles.

Images References :

Source: cleartaxindia.com

Source: cleartaxindia.com

80EEB New Tax Exemption on Loan for Purchase of Electric Vehicles, Amongst the various tax saving investments, buying an electric vehicle (ev) has become one of the most lucrative ways to reduce the tax liability. Under the fame india scheme, electric cars are eligible for an incentive of up to rs.

Source: www.youtube.com

Source: www.youtube.com

Section 80EEB Tax Exemption on Purchase of Electric Vehicle CA, Under the new section 80eeb, a person buying an electric vehicle in loan can claim a deduction in. The income tax act of india contains a section called 80eeb that offers tax advantages on interest paid on loans taken out for the purchase of electric vehicles.

Source: www.apnaplan.com

Source: www.apnaplan.com

80EEB Tax Exemption On Loan For Purchase Of ⚡ ⚡ Electric Vehicles, However, it’s essential to note the. Buying an electric vehicle with a vehicle loan can make you eligible for income tax benefits under the 80eeb.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

EV Policies and Subsidies of 13 States of India All State EV Policies, There are plenty of electric vehicle models on the market, and with increased sales, some automakers are planning to introduce new models. The income tax act of india contains a section called 80eeb that offers tax advantages on interest paid on loans taken out for the purchase of electric vehicles.

Source: www.acea.auto

Source: www.acea.auto

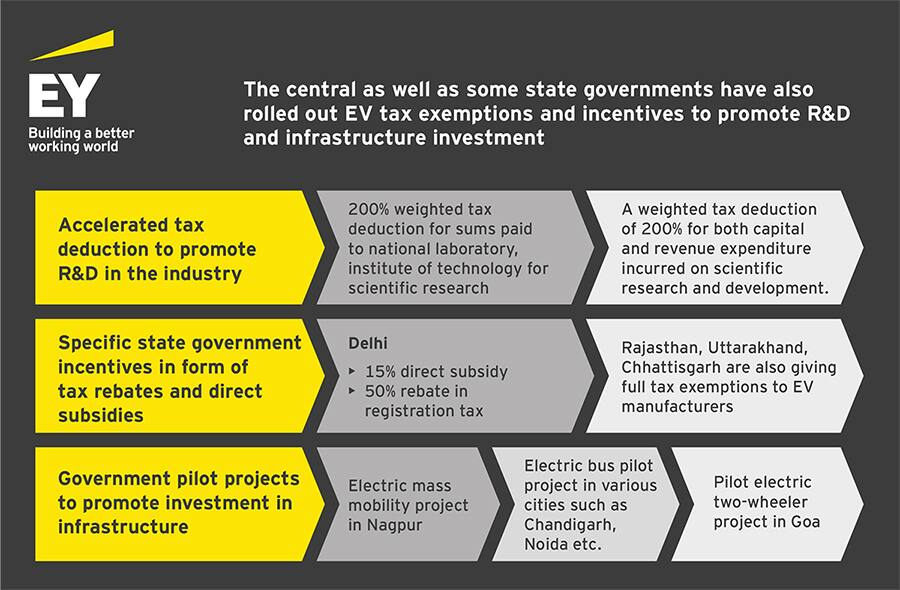

Overview Electric vehicles tax benefits & purchase incentives in the, You might feel that purchasing an electric vehicle is costlier than buying an internal combustion engine vehicle, but that is only because of the higher upfront cost. The section is applicable to individual taxpayers and offers a tax deduction of up to ₹ 1.5.

Source: www.taxastute.com.au

Source: www.taxastute.com.au

The Electric Vehicle (EV) FBT Exemption from 1 July 2022 Tax Astute, Additionally, individuals are allowed an additional deduction of rs 1.5. You might feel that purchasing an electric vehicle is costlier than buying an internal combustion engine vehicle, but that is only because of the higher upfront cost.

Source: www.indiandrives.com

Source: www.indiandrives.com

Electric vehicles get full tax exemption in Maharashtra, Under the fame india scheme, electric cars are eligible for an incentive of up to rs. Another significant incentive is the exemption from goods and services tax (gst) on electric vehicles.

Source: www.moneycontrol.com

Source: www.moneycontrol.com

'Future of Electric Vehicles in India Challenges and Opportunities, 1,50,000 under section 80eeb on the interest paid on loan taken to buy electric vehicles. However, it’s essential to note the.

Source: kbfinancialadvisors.com

Source: kbfinancialadvisors.com

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, This deduction is specifically designed for the purchase of electric vehicles. While some clauses in the income tax act offer tax exemption to the return filers, buying a vehicle and the related loan doesn't provide them with any relief.

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, You might feel that purchasing an electric vehicle is costlier than buying an internal combustion engine vehicle, but that is only because of the higher upfront cost. Section 80eeb gives tax deductions of up to ₹1,50,000 on interest paid on loan amount on the purchase of electric vehicle.

In 2019, The Government Announced Tax Benefits Under The New Section 80Eeb.

The income tax act of india contains a section called 80eeb that offers tax advantages on interest paid on loans taken out for the purchase of electric vehicles.

Buying An Electric Vehicle With A Vehicle Loan Can Make You Eligible For Income Tax Benefits Under The 80Eeb.

1,50,000 under section 80eeb on the interest paid on loan taken to buy electric vehicles.